BWT Precision AutoTrader

Innovation and Excellence in Automated Trading Tools Since 2003

BWT Precision Autotrader

Blue Wave Trading is one of the oldest vendors in the NinjaTrader Ecosystem. We first offered automation in NinjaTrader over 17 years ago. Our original logic and Volatility based algorithm has stood the test of time. Volatility is always present and is an enduring concept that is well documented, understood, and respected by all professional traders, Hedge Funds and Money Managers.

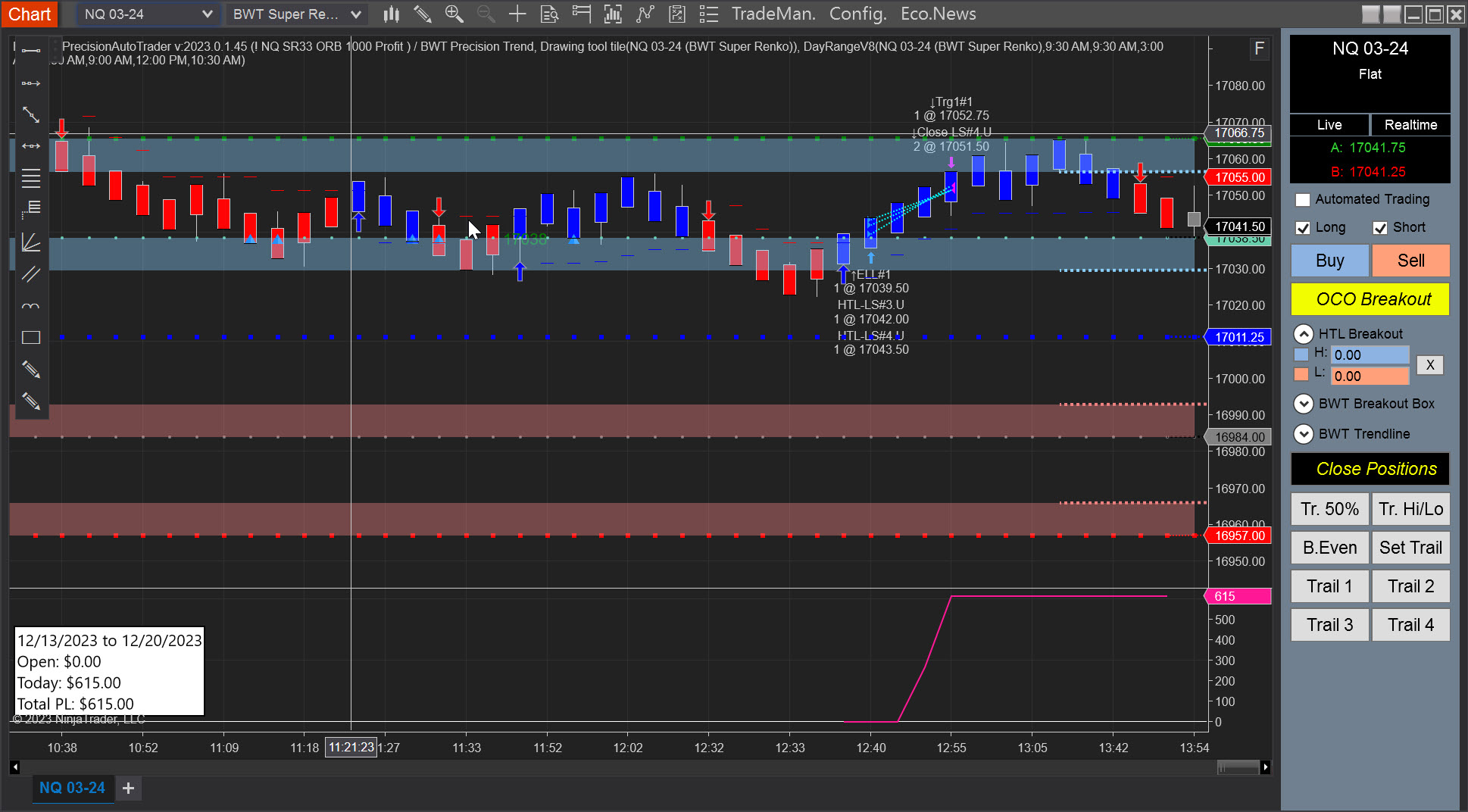

The BWT Precision Autotrader for NinjaTrader 8 is a state of the art trading tool that automates the most used tasks in manual trading using a proven volatility based algorithm and allows for addition rules such as Open Range Break, Trendline Break, Breakout Box and more.

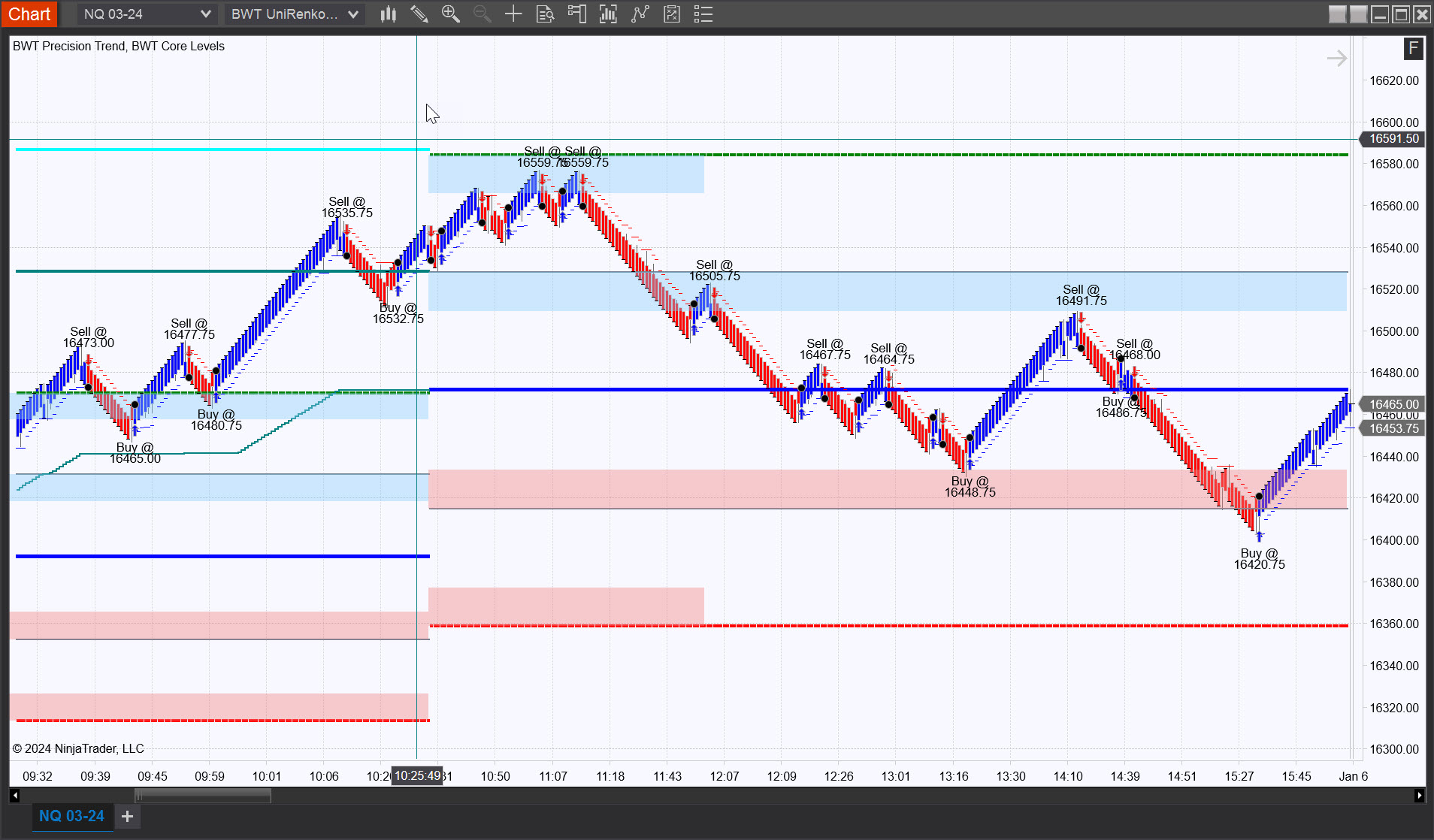

The BWT Core Levels will help you to visualize where and when to buy and sell like nothing you have ever experienced before. Think of supply demand zones clarified in a simple way that shows what make or break levels professional traders are looking at without confusing order flow graphics.

BWT PRECISION AUTOTRADER FEATURES

BWT PRECISION AUTOTRADER FEATURES –

All FUNCTIONALITY BELOW IS 100% AUTOMATED

While BWT is capable of being fully Automated, our software is best implemented with some user discretion such as engaging automation when price action indicates a setup, or is in sync with any methodology that works for you.

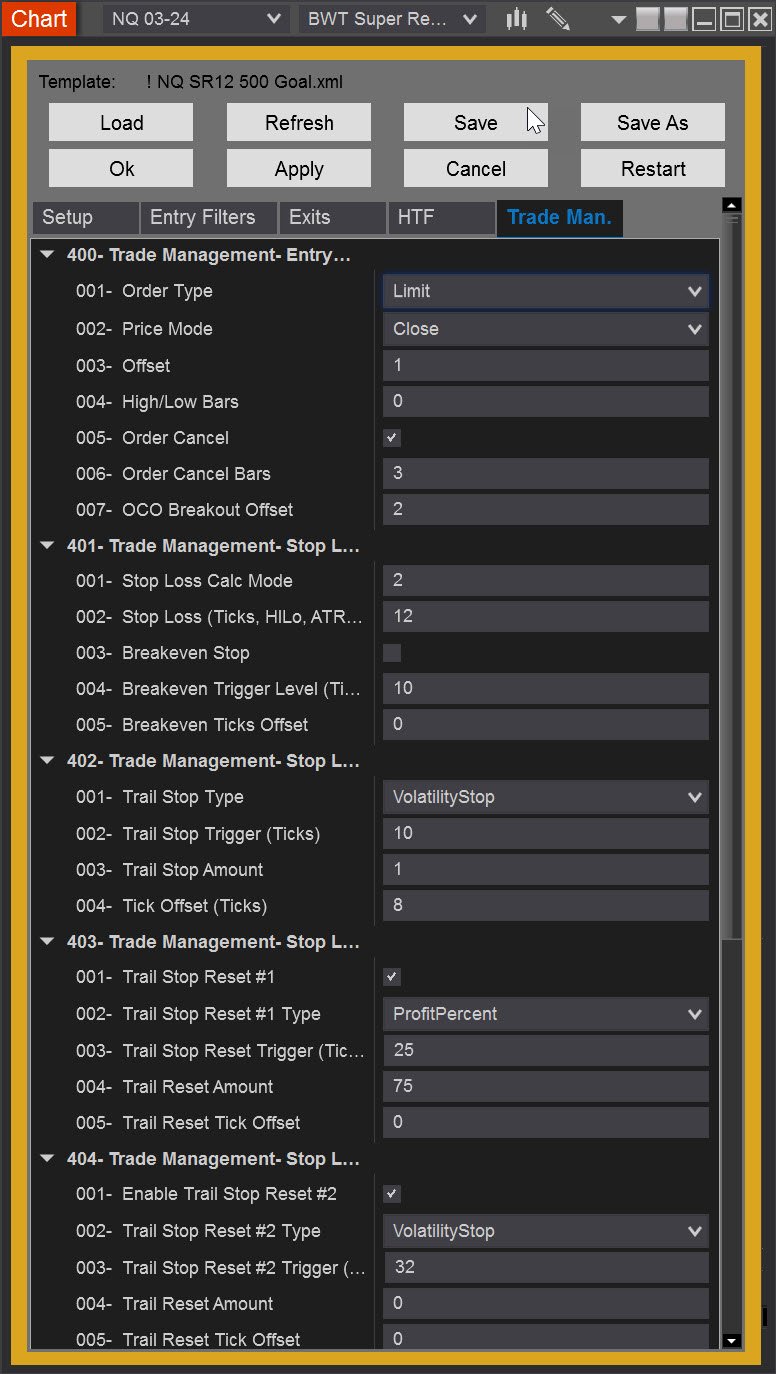

BWT TRADE MANAGEMENT: Unmatched Speed and Efficiency of Execution

- BWT Configuration Panel Easily change any Parameter in our Config Panel even in Real Time. No searching for parameters

- BWT Trade Manager – Allows 1 button click to tighten trail stops, 1 click to trail by current bar, Move to Breakeven, close positions, enter OCO order, and more

- Multiple Trail Stops by Bars, Ticks, Profit Percent, or Volatility Stop

- Trail Stop Reset – Reset up to 3 levels of Trail Stops to reduce risk and lock in profit

- Mix and Match Trail Stops – Change type of trail Stop as the trade develops. Begin with any trail stop, change to ticks, bars, Volatility Stop or Percentage of Profit.

- NO OVERFILLS – A dangerous Condition caused by inferior programming that may cause an order to be filled because other orders were not confirmed to be cancelled or other conditions.

Operation Modes

- 100% Automated Trading Mode – Fully Automated Entry, Exit and Money Management, Profit Targets Trail Stops and Daily Goals

- Manual Entry Mode with Automated Money Management, Profit Targets and Trail Stops and Daily Goals

- Long or Short Only Mode – Automatic Signal Execution one direction + automatic trade management

- Realtime Combination of Manual & Automatic entry + automatic trade management

- Realtime interaction and control of automatic trade management

ENTRY Modules

- BWT Precision Trend AlgorithmOur Original Universal Volatility Based Algorithm Trades any Market, Bartype or Time Frame

- BWT Line Break AlgorithmA Custom Algo Designed to effectively Trade Line Break Charts

- BWT Breakout BoxDraw a Zone on any chart to enter a position only if price enters and exits the “zone” can be long or short only or both.

TRADE FILTER – ENTRY

- The Original BWT Volatility Algo Logic Conceived by the Developer in 2005

- Open Range Breakout Filter (ORB) – Trades Long Only if Above Session Open, Trade short Only if below. Option to set a No Trade Zone (NTZ) x ticks above or below open. This filter is simple but is extremely reliable works very well in several situations and avoids small whipsaw pullbacks when the market moves big in one direction.

- 3 Line Break Algo. Effectively trade 3 Line Break in any time frame any bartype.

- Filter entry by Higher Time Frame (HTF) Small and Large Time Frame must be in agreement to enter a trade.

- BWT MA Filter – filter by any of four different moving averages

- BWT Parabolic Entry Filter and Exit Signal

- Coming Soon Automated entry at BWT Core Levels

Professional Programming

- Programmed in NinjaTrader Unmanaged mode (Advanced Skillset Required)

- Complex events processing Trade Workflow to prevent order related errors

- Custom Runtime Application – proper handling of order rejections, connection loss and error monitoring

- And Much More to allow you to trade with confidence

BWT Trading Systems Pricing and Ordering

NinjaTrader Licenses > New Full licenses | Upgrades & Renewals

- Includes access to training videos and BWT world class technical support

- If you decide to purchase Please download, sign and return the BWT License Agreement

APEX TRADER FUNDING

Use Coupon code Save90 for 50-90% off any Trading Account

- Please visit the Frequently Asked Questions page for more details about BWT trading products

- The license is for ONE computer, each additional PC is $150 – please contact us to arrange.

BWT Precision Autotrader

Annual Subscription Only:BWT Precision AutoTraderfor NinjaTrader 8 (Annual Payment)

BWT Precision Autotrader1st Annual Payment: $995includes BWT Indicators & BarTypes for NinjaTrader 8

$1495.00

BWT Precision Indicators

BWT Core Levels

BWT Globex Levels

BWT Swing Levels

BWT Price Action Swing

BWT Precision Trend

BWT Precision Trend MTF

BWT Ai-MA

BWT Precision MA

BWT Precision MA Convergence

BWT Precision Natural Bands

BWT Precision Step MA

BWT 3 Line Break

BWT Tick Extremes

BWT Volume Profile

BWT Precision Oscillator

BWT Precision Parabolic

BWT Precision Pct R Stochastic

$995.00

BEFORE MAKING A PURCHASE: ALL SALES ARE FINAL AND THERE ARE NO REFUNDS. IF YOU DO NOT AGREE WITH THIS, PLEASE DO NOT PURCHASE. In using this website you agree to the Terms and Condition of Sale and the BWT License Agreement . 5% sales tax added to all transactions

Trading Disclaimer

NOTE: There are no guarantees of performance or profits. While the system is capable of trading many different time frames, trading on too small of a time frame, may not be suitable as the speed of price and bar formation could cause conflicts, especially in volitile markets. It is not necessary to trade a time frame where there are hundreds of trading opportunities. See Below for additional risk and suitability disclosure.

CFTC RULE 4.41

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.